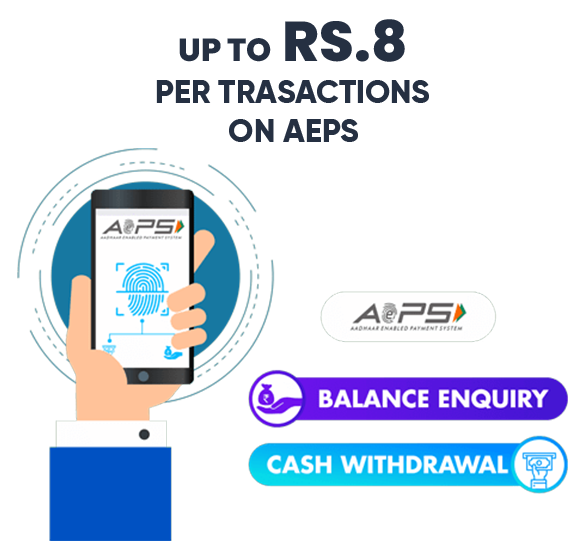

Get the best commissions

Compact AEPS Device

Easy to Set-up

Secured and Authentic

Get the AEPS Device for your store | Start offering the AEPS service

AEPS stands for the Aadhaar Enable Payment Service. The customers can perform transactions using their Aadhaar card from their Aadhaar Enabled Bank Account. AEPS machines are like the PoS machines, the micro ATM also provides the AEPS service. To use the AEPS service, the customer shall have to enter their Aadhaar Number in the machine and authenticate with their fingerprint. By doing that, the customer will be able to carry out the transaction.

To use the AEPS service first, the user will need to link their bank account with their Aadhaar Number. Also, the user shall require contacting the bank for enabling the AEPS service on a particular account.

The payee or beneficiary does not require having the AEPS account. The beneficiary shall have a bank account and that’s enough to receive the funds.

An intra-bank (ON-US) transaction where an Aadhaar initiated transaction has effects only in accounts within one and does not necessitate an interbank settlement. A Customer can use an Account holding bank terminal deployed on the field for availing AEPS Service.

An inter-bank (OFF-US) transaction is one where there is a movement of funds from one bank to another necessitating an interbank settlement. Customers can approach other Bank terminals for availing AEPS services.

Business Correspondent (BC) is an approved Bank Agent providing basic banking service using a Micro ATM (terminal) to any bank customer wishing to avail their bank BC service.

The Reserve Bank of India has not implied any limit on Fund Transfer through AEPS. But the banks have their set limit on AEPS fund transfer. These limits are very by the banks.

AEPS is the model, led by the banks in India that AEPS service allows interpretable Financial Transactions at PoS by the banking correspondent using the Aadhaar authentication.

This AEPS service helps the bank customers to use the Aadhaar Card as his/her Identity for their Aadhaar enabled bank account. With this, the user can get benefits from the basic banking services like depositing cash, withdrawing cash, interbank fund transfer, balance inquiry, and obtaining a mini statement through a business correspondent.

KuberJee offers AEPS services to their merchants. The business personnel can get this premium service from KuberJee and offer it to their customers. There’re a few documents and details required to get this service enabled at your store. The users are required to have their Aadhaar Enabled bank account to get the benefits of this service.

Aadhaar enabled payment system includes the following services, which are:

To use the AEPS service, the customers shall have the Aadhaar Enabled Bank Account. The customers will require:

Here are the benefits of AEPS service that the customer can have.

To know more about KuberJee or if you have any queries related to KuberJee Services, do contact us on +91 2617123466 or write us at support@kuberjee.com